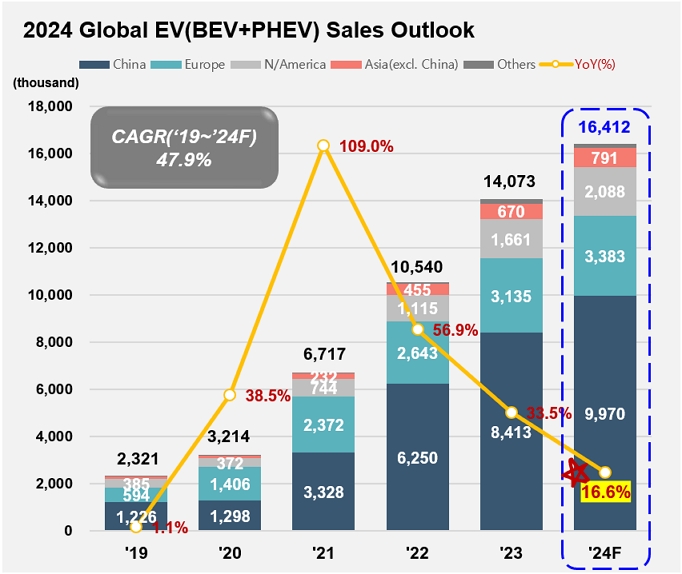

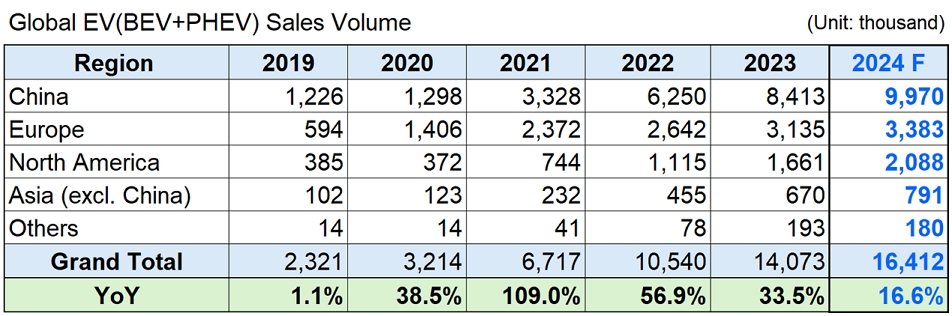

2024 Global[1] EV Market Expected to

See Sales of 16.4 million Units, 16.6% YoY Growth

- EV Market Growth in 2023 Posted 33.5% → EV Market Growth in 2024 Expected to Be 16.6%

Despite concerns about a sluggish demand, the global EV market posted a 33.5% growth with 14.07 million units sold last year. However, with short-term economic uncertainties aggravated, OEMs have modified their production plans and sales strategies, leading to a slowdown in the growth of global EV market this year.

(Source: 2024 NGBS presentation material by SNE Research Vice President James Oh)

On March 14, based on its projections in <2024.1H> Global xEV Market and Battery Supply/Demand Outlook report (~2035), SNE Research forecasts that the global EV sales is expected to post approximately 16.41 million units in 2024, a 16.6% YoY growth – 16.9%p declined from 33.5% of last year. Major reasons for such slow down are as follows: early adopters’ completion of EV purchase and a subsequent reduction in potential demand, a shortage of charging infrastructure, and shrunken real market and consumer confidence due to high prices and high interest rates.

(Source: 2024 NGBS presentation material by SNE Research Vice President James Oh)

The world’s biggest EV market, China saw the EV penetration rate exceeding 30.0% amidst continuous high growth driven by BYD. However, due to a sluggish demand in the market caused by economic downturn and termination of EV subsidy policy, the EV market in China has started to enter the era of moderate growth this year.

In Europe, the growth of electric vehicles, of which profitability is relatively low, is expected to slow down as most of OEMs may meet the CO₂ emission targets set in the Regulation with their current level of EV sales. However, with the CO₂ emission regulations significantly tightened from 2025, the EV market in Europe is expected rebound from the 2nd half of 2024, mainly focusing on BEV.

In North America, Tesla, who has been leading the growth in the region, has demonstrated a relatively poor performance which is below the growth average among other OEMs due to the issues with supply of 4680 battery and delays in the launch of entry-level, low-cost model. With the Presidential election scheduled at the end of this year, the election result could possibly hobble the growth of green industry and rather foster the traditional industry, leading to a sudden rise of possible speed bumps in the electrification process. On the other hand, OEMs like GM, Stellantis, and Hyundai-KIA have decided to strengthen their EV business mainly in North America and expand the launch of new models. Given these circumstances, the North American region is expected to see a relatively higher growth than other regions.

In Asia and other regions, the EV market growth is forecasted to remain as it has been, mainly driven by OEMs. Particularly in Thailand, the Chines OEMs have started to produce and sell their EVs in earnest, presumably stimulating the competition for dominance in the EV markets of ASEAN 5 countries.

SNE Research holds ‘The 7th Next Generation Battery Seminar and 1st Tutorials 2024’ for 4 days from March 21st to 26th (except weekends) to further discuss the current market status and outlook as well as to create an opportunity for industry experts to share their thoughts and expand their network.

[1] The xEV sales of 80 countries are aggregated.